5 Steps for Business: How to Manage COVID-19

Last updated: June 24, 2020

Step 1: Take Care of You and Your Employees

1 . Take care of you and your employees first

- Take care of your physical and mental health - you can use the community resources on our COVID-19 website page for supports and resources

- Implement prevention measures and prevent the spread - you can use the prevention section, along with the checklists and guidelines under Business Resources on our COVID-19 website page to help

- Consider how you will establish your work place, whether it be remote workplaces, shift work or work sharing - you can use our business resource section and virtual business tools on our COVID-19 website page for guidance and assistance

Remember: In case of a cabin pressure emergency, put on your own mask first before assisting others.” A simple concept that makes sense. You can't help others for very long if you don't take care of yourself first

2. Compile your list of contacts that can provide you assistance, advice and guidance

Key contacts would include:

- Chamber of Commerce

- Labour Lawyer and/or HR Consultant

- Government contacts - local, provincial and federal and the numbers you need Insurance Broker

- Banker

- Accountant

- IT Service Providers

- Business Advisor

- Suppliers

Make sure to use our Call Centre drop down under Community Resources on our COVID-19 website page for contact numbers and our business directory, if you don't yet have professional advisors as part of your core team and contacts.

3. Consult with an employment lawyer or HR consultant

If you are looking at layoffs and terminations, you will need to make sure you are protecting yourself and your employees and doing the right thing. A lawyer or HR consultant can assist and provide professional advice and consultation. You can also use the business resource section on our COVID-19 website page for checklists and guidelines, along with employment standards, labour, occupational health and safety and workers' compensation information.

4. Make sure you communicate with your team and your clients/customers

Make sure your team is aware of supports available. There are a number of supports available to employees and individuals, such as the Canada Emergency Response Benefit and other supports and deferrals, if you do have to go the route of layoffs. Communicate with your team and make them part of the decision making process. You can also refer them to the Chamber of Commerce Funding and Assistance section where they can find supports for individuals to help guide them on resources available.

You also need to make sure you connect and communicate with your customers and clients to keep them up to date with your actions and activities. Your customers/clients need to know if you're open and what your hours are, along with how they obtain products and services from you, while physically distancing. Look for ways to communicate, whether through email or virtual business tools. You can find some tools you can use under our Virtual Business Tools section of our COVID-19 website page.

Step 2: Analyze Your Business Situation

1 . Review your Business Plan

If you don't have one, now might be a good time to create one. You may also want to ensure that you create a business continuity plan and an emergency response plan. You should also look at your insurance policies and options. You can find these tools in our Templates and Tools section under our Business Resource section of our COVID-19 website page, in addition to the templates and guides under our Quick Links section.

2. Look at your HR policies as well as employee data

If you don't have HR policies, you may want to look at the Employment Standards Toolkit found under the Employment Standards section of our Business Resources on our COVID-19 website page.

If you need to change your employee structure, whether reduced hours or layoffs, or even longer term human resource planning, the things you should know include employee start dates, current wage rates, how much vacation and overtime is owed/accrued. You will need to know the employment standards code and make sure to get advice before making layoff decisions. You'll also need to consider the cost of lost productivity through employee turnover, including layoffs, hiring/rehiring and training employees. If you are able to keep employees, determine key roles within your organization, what transferable skills can be used to perhaps put employees in different roles and responsibilities and consider if they can be cross trained in order to take on new roles or combined roles.

3. Determine your financial situation

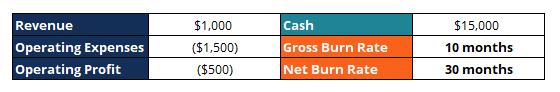

You need to determine your monthly expenses including payroll, overhead costs, contracts and figure out your monthly “burn rate”. Your gross “burn rate” would be the amount of cash spent each month [rent, salaries, other overhead], your net “burn rate” is calculated by subtracting operating expenses (gross burn rate) from revenue.

4. Obtain Financial Advice

Talk to your account manager at your bank and discuss your concerns with your accountant. If you don't yet have contacts you can refer to our business directory to find someone and take a look at the financial institutions section under Funding and Assistance on our COVID-19 website page for links to information.

Step 3: Access Funding, Credit and Capital

1. Look at options for funding and supports

Through our COVID-19 website page, you can find funding and assistance for business including:

- Canada Emergency Wage Subsidy: A 75 percent wage subsidy for qualifying businesses, for up to 3 months, retroactive to March 15, 2020. Eligible employers can use the Canada Emergency Wage Subsidy Calculator and the Canada Emergency Wage Subsidy Step by Step Guide to help.

- Canada Emergency Commercial Rent Assistance Program

- City of Medicine Hat Business Innovation Grant

- Temporary Wage Subsidy: 10 percent wage subsidy for qualifying businesses by reducing payroll remittances to the CRA. (Learn more)

- Large Employer Emergency Financing Facility

- Regional Relief and Recovery Fund

- Travel Alberta Cooperative Investment Program

- Work Sharing Program to avoid layoffs (Work Sharing Program Overview) and optimize work arrangements.

2. Make sure you speak with your financial institution about options available including:

- Canada Emergency Business Account

- Business Credit Availability Program

- Small and Medium-sized Enterprise Loan & Guarantee program

- Programs through ATB and Alberta Credit Unions including the ATB BoostR Crowdfunding platform

- Options through Export Development Canada

3. Look at other supports being provided by your insurance provider, benefit provider or accountant. Examples include:

- Business Insurance: How is coverage triggered? (Insurance Bureau of Canada)

- Chambers of Commerce Group Insurance business assistance and Business Resource Centre

- MNP Insolvency Services

4. Consider industry specific supports, if you are in a particular industry, including:

- Agriculture and Agri-Food

- Alberta Gaming, Liquor, Cannabis

- Innovation Companies: Funding for R & D and testing prototypes

- Retailers

- Tourism Operators

You can check out the industry specific resources in the Business Resource section on our COVID-19 website page or use the Government of Canada Business and Industry Search Tool or the Deloitte Small Business Relief Search Tool to assist you in finding supports and resources.

Step 4: Find Ways to Cut Costs

1. Reach out to your suppliers and supply chain for options

Look at your payables and connect with suppliers to see if you can arrange payment plans. Are there orders you don't require that you can suspend or delay? Are their unnecessary costs that you can cut? Try to look for potential relief options to reduce your expenses.

2. Assess options for tax and payment deferrals

There are a number of deferral options that have been made available including:

- Corporate Tax Deferral

- Deferral of Sales Tax Remittance and Customs Duty Payments

- Education Property Tax Deferral for Business

- Income Tax Filing and Payments

- Tourism Levy deferral and remittances

- WCB Premium Deferral for Private Sector

- Canada Post Hold Mail and Mail Forwarding Services

3. Use the Utility Deferrals:

All residential, farm and small commercial customers can defer utility bill payments for 90 days (until June 18) without penalty and disconnection. City of Medicine Hat Customers who fall within this range (residential/farm/small commercial) don’t have to apply to enact this. However, for all other customers requiring the deferral, you are required to contact collections@medicinehat.ca or call 403.529.8113. City of Medicine Hat customers can find out more here.

4. Speak to your financial institution and mortgage broker about payment deferrals on loans and mortgages

You can find additional information and assistance on our COVID-19 website page under Funding and Assistance.

Step 5: Look at How You Will Emerge

1. Evaluate remote engagement and productivity

Consider what tools you can continue using that you have learned through remote work engagement and productivity measures.

- Make sure you are re-adjusting as you go and consider what policies and processes you need to put in place now and into the future. These might be things like Virtual workplace policies and procedures and rules of engagement

- Consider your communications tools; what can you use and how will you use them in the future i.e. video conference?

- How do you provide support to your team now and in the future i.e. VPN connectivity, remote phone options, work-sharing, changes in roles/responsibilities?

- How are you adjusting your leadership style to adapt?

2. Evaluate options to innovate

Consider how your business can adapt and talk to your team about what ideas they have now and in the future. Look at other industry leaders and what they are doing to sustain their business during this time and how you can mirror those same tactics.

- What product or service do you offer now and is this changing? Can it change?

- Are you offering your product or service online?

- Are you offering delivery or pick up services?

- What online learning tools and platforms can you use to deliver your service, advice or training?

- How have you/can you increase productivity?

- What technology and virtual business tools are you using?

3. Ask yourself and perhaps current and potential customers some key questions

- How do you engage your current customers?

- How will you serve new customers/different customers?

- Identify how you meet people's needs; how you solve their problems and how you can offer something amazing.

4. Pivot

How can you pivot? This is a fundamental change in direction without changing purpose, passion or values. What do you aspire to be?

- Look for opportunities for your business and refine your sales and marketing plan

- Evaluate your channels and how you sell/market your product

- Create and share experiences, stories and values through social media engagement

- Consider how you provide a valuable experience to your target market

- Take the time to refocus for the future, we can start by asking the questions about where we need to focus our time

- Evaluate the changes you can make in your business - perhaps its just a minor tweak to your product offer or a major change where you need to pivot

Make sure to take webinars and online courses, either by viewing our weekly updates or viewing options through our pandemic training calendar to learn new strategies and tactics during this time so you can emerge stronger.

See Also: 5 Steps to Relaunch Your Business